- Beranda

- Komunitas

- News

- Berita Luar Negeri

Asia overtakes America for the first time in VC funding; claims top 5 deals global

TS

methadone.500mg

Asia overtakes America for the first time in VC funding; claims top 5 deals global

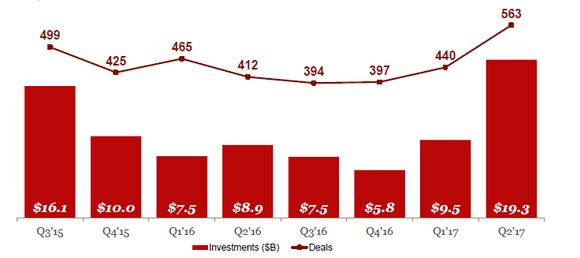

Asian companies raked in venture capital investments of $19.3 billion in the second quarter this year, outpacing funding received by counterparts in the US for the first time.

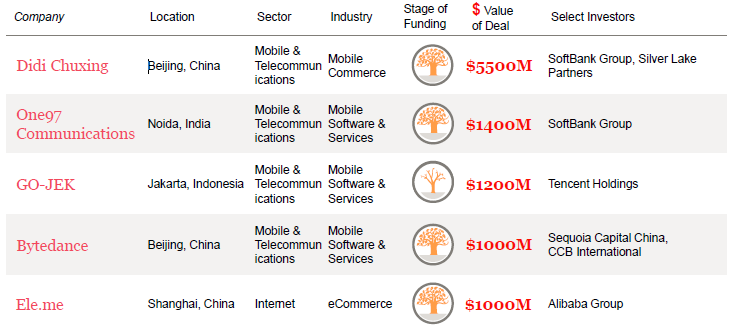

A series of $1-billion+ VC deals, including Didi Chuxing’s landmark $5.5-billion round, propelled the continent up the leaderboard in the quarter.

In fact, Asia more than doubled the amount of funding its tech startups raised in the three months ended June 2017, compared to the previous quarter, according to the latest analysis by CB Insights and PwC. The report termed this investment shift as Asia finding a second gear.

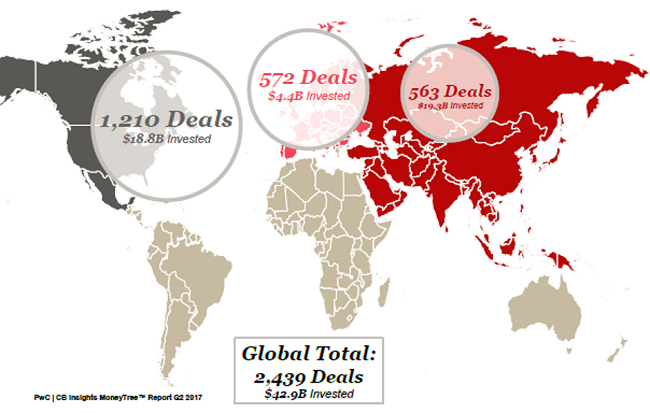

In comparison, venture capital investments in the US (North America) in the same period totalled $18.4 billion, growing a measly 4 per cent from the previous quarter.

For every dollar invested globally, 45 cents went to Asian firms, the report noted. Apart from Didi Chuxing’s VC round, which was the largest ever investment in a private firm, other notable deals in Asia in the quarter included India’s One97 Communications’ (PayTM) $1.4 billion fundraise from Softbank Group, Go-Jek’s $1.2-billion round, and China’s Bytedance and Ele.me raising $1 billion each. Asia also accounted for top five deals globally in Q2 2017, all of which are upwards of a billion dollars.

While billion-dollar deals are uncommon globally, and even harder to find in Asia with perhaps the exception of China, recent quarters have seen consumer internet and technology startups across India, Singapore and even Indonesia recording such markers. The growth in such mega deals is a reflection of the growing influence of the continent, and also of companies here making great strides in chipping away at the dominance that Silicon Valley has enjoyed for long.

Globally, the number of VC deals increased marginally on a quarterly basis from 2,400 to 2,439 in Q2. A surge in funding activity in Asia pushed deal value by 53 per cent from $28 billion in Q1’17 to $42.9 billion in Q2’17. In fact, the Q2’17 quarterly dollar total even eclipsed the mark of $40.6 billion set in Q3’15, the report said.

The second quarter also saw Europe and Asia hit 8-quarter dollar funding highs. Asia’s mega rounds valued at $100 million and more surged 42 per cent on a quarterly basis. The North American region saw 31 mega-deals, the highest in the US since the peak of 36 deals two years ago.

As far as North America is concerned, about $8.7 billion was channelled into the internet sector through 505 deals, $2.4 billion for mobile and telecommunications (168 deals), $3 billion for healthcare (166 deals), $900,000 for Software (77 deals), and $800,000 for consumer products and services (51 deals). “Q2 was a tale of two trends. US deal activity continued its multi-quarter downward trend, but the growth rate of investments in dollar terms accelerated from the first quarter.

A surge in mega-round deals to the second highest level seen to date helped drive a robust level of quarterly VC funding,” Tom Ciccolella, Partner, US Ventures Leader at PwC, said. “Internet deal share matched last quarter’s figure at 44 per cent. The sector’s deals as a proportion of all US activity has remained at 45% or below for three consecutive quarters,” the report added. Some of the hottest thematic areas were digital health, cyber security and real estate tech.

Largest deals in North America in the quarter included San Francisco-based Lyft – which raised $600 million from InMotion Ventures, KKR, and Graphene Ventures – Outcome Health ($500 million), Group Nine Media ($485 million), Houzz ($400 million), and Guardant Health ($360 million). Furthermore, the report revealed that globally, nine VC-backed companies had became unicorns – startups valued at over $1 billion – in the quarter, up from just three in the first quarter this year. This marks the highest quarterly total again since 2015, when 16 companies had joined the unicorn club. Meanwhile, most active VC firms in the period were 500 Startups (46 deals), New Enterprise Associates (40 deals), Accel Partners (27 deals), Sequoia Capital China (22 deals), and Google Ventures (22 deals).

Read more at: https://www.dealstreetasia.com/stori...nsights-77547/

anasabila dan sebelahblog memberi reputasi

2

1K

3

Komentar yang asik ya

Urutan

Terbaru

Terlama

Komentar yang asik ya

Komunitas Pilihan