- Beranda

- Komunitas

- News

- Berita dan Politik

Indonesia's palm oil export ban leaves global buyers with no plan B

TS

mabdulkarim

Indonesia's palm oil export ban leaves global buyers with no plan B

/cloudfront-us-east-2.images.arcpublishing.com/reuters/76HYMX53I5MC5HPZBVOG6LGDXA.jpg)

Summary

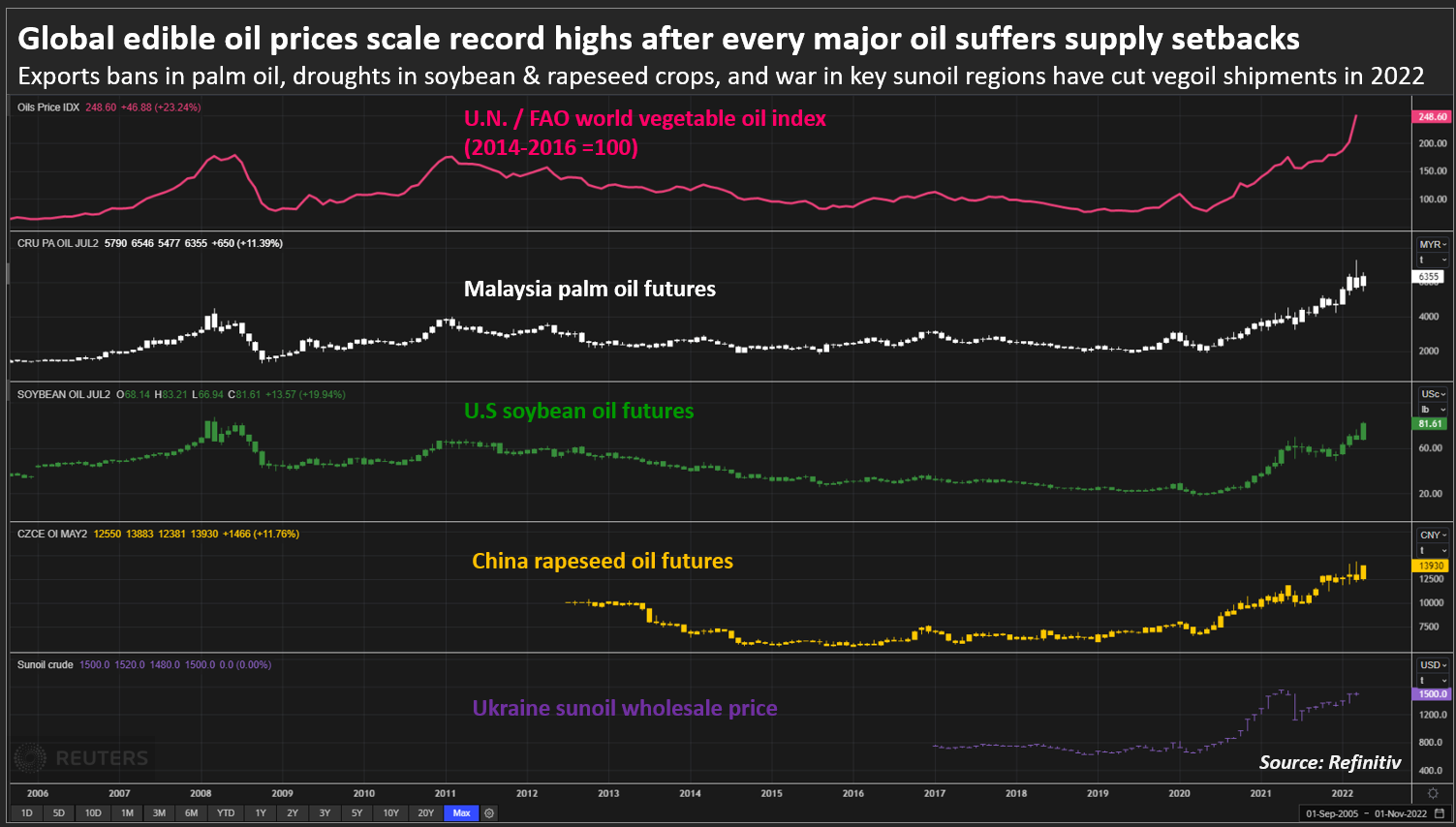

All vegetable oil prices set to jump on supply disruption

Buyers can't replace Indonesian palm oil shortfall

Soyoil, canola oil supply hit by drought, sunflower oil by war

Refiners holding lower stocks, need to purchase at record prices

MUMBAI, April 25 (Reuters) - Global edible oil consumers have no option but to pay top dollar for supplies after Indonesia's surprise palm oil export ban forced buyers to seek alternatives, already in short supply due to adverse weather and Russia's invasion of Ukraine.

The move by the world's biggest palm oil producer to ban exports from Thursday will lift prices of all major edible oils including palm oil, soyoil, sunflower oil and rapeseed oil, industry watchers predict. That will place extra strain on cost-sensitive consumers in Asia and Africa hit by higher fuel and food prices.

"Indonesia's decision affects not only palm oil availability, but vegetable oils worldwide," James Fry, chairman of commodities consultancy LMC International, told Reuters.

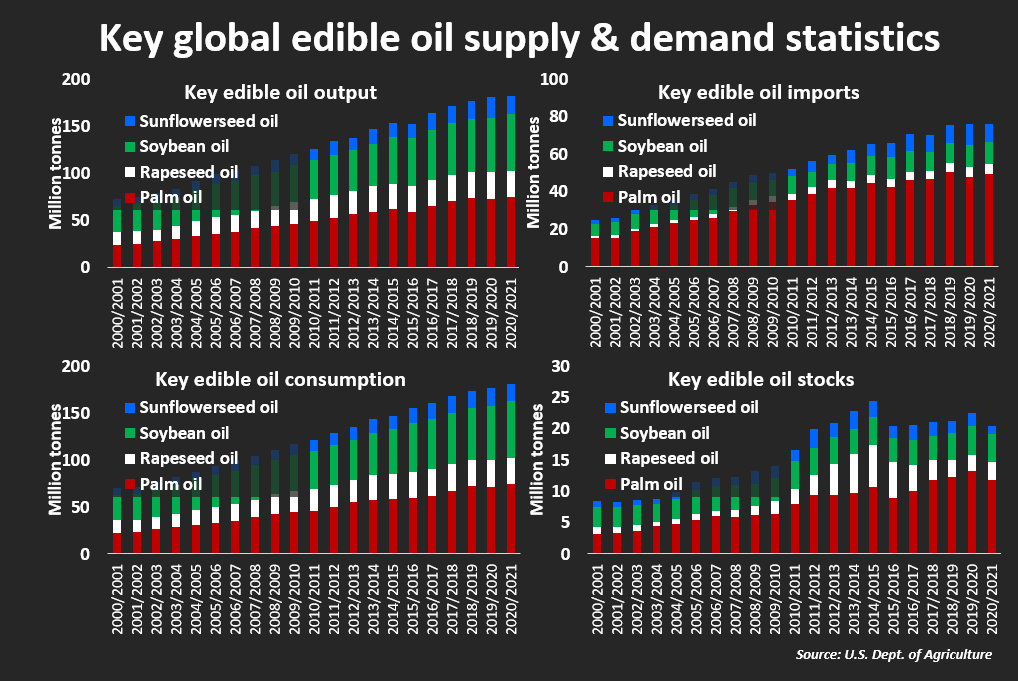

Palm oil - used in everything from cakes and frying fats to cosmetics and cleaning products - accounts for nearly 60% of global vegetable oil shipments, and top producer Indonesia accounts for around a third of all vegetable oil exports. It announced the export ban on April 22, until further notice, in a move to tackle rising domestic prices. r

"This is happening when the export tonnages of all other major oils are under pressure: soybean oil due to droughts in South America; rapeseed oil due to disastrous canola crops in Canada; and sunflower oil because of Russia's war on Ukraine," Fry said.

Vegetable oil prices have already risen more than 50% in the past six months as factors from labour shortages in Malaysia to droughts in Argentina and Canada - the biggest exporters of soyoil and canola oil respectively - curtailed supplies.

Global edible oil prices scale record highs after every major oil suffers supply setbacks

Buyers were hoping a bumper sunflower crop from top exporter Ukraine would ease the tightness, but supplies from Kyiv have stopped because of what Russia calls its "special operation" in the country. read more

This had prompted importers to bank on palm oil being able to plug the supply gap until Indonesia's shock ban delivered a "double whammy" to buyers, said Atul Chaturvedi, president of trade body the Solvent Extractors Association of India (SEA).

Importers such as India, Bangladesh and Pakistan will try to increase palm oil purchases from Malaysia, but the world's second-biggest palm oil producer cannot fill the gap created by Indonesia, Chaturvedi said.

Indonesia typically supplies nearly half of India's total palm oil imports, while Pakistan and Bangladesh import nearly 80% of their palm oil from Indonesia.

"Nobody can compensate for the loss of Indonesian palm oil. Every country is going to suffer," said Rasheed JanMohd, chairman of Pakistan Edible oil Refiners Association (PEORA).

Key global edible oil statistics

In February, prices of vegetable oils jumped to a record high as sunflower oil supplies were disrupted from the Black Sea region.

The price rise raised working capital requirements for oil refiners, who were holding lower inventories than normal in anticipation of a pullback in prices, said a Mumbai-based dealer with a global trading firm.

Instead, all oil prices have rallied further.

"Refiners have been caught on the wrong foot. Now they can't afford to wait for a few weeks. They have to make purchases to run plants," the dealer said.

As Indonesia has allowed loading until April 28, consuming countries will have enough supply for the first half of May, but could face shortages from the second half, said a refiner based in Dhaka.

South Asian refiners will only slowly release oil into the market as they know supplies are limited, he said.

In India, the world's biggest vegetable oil importer, palm oil prices rose by nearly 5% over the weekend as industry prices in shortages in the coming months. Prices also rose in Pakistan and Bangladesh.

https://www.reuters.com/business/ind...-b-2022-04-25/

Karena ini banyak yang khawatir di India secara makanan banyak pake minyak sawit dan peluang harga makanan di India bakal naik

Secara nggak langsung Indonesia akan membuat banyak masyarakat di Asia selatan menderita karena masalah ini

Indonesia's palm oil export ban to hurt food producers, drive prices up

Indonesia, the world's top palm oil producer, will soon ban exports of the most widely used vegetable oil in a bid to ease domestic shortages and tackle soaring prices.

"The government has decided to ban exports of cooking oil and its raw materials starting on Thursday April 28, 2022 until further notice."

The export ban on the vegetable oil is expected to raise prices for global food producers, including South Korea, as the country is heavily dependent on palm oil imports from Indonesia.

Just last year, South Korea imported about 342-thousand tons of palm oil from Indonesiaaccounting for more than half of total imports.

Palm oil is widely used in processed foods.such as snacks like cakes and sweets and Korean instant noodles ramyeon.

Local food producers usually have up to three to six months of suppliesso consumers would not immediately feel the pinch from higher prices.

But, if palm oil prices surge and a supply shortage persists, this would further drive food prices up.

Already the costs of instant noodles in South Korea is growing at a fast pace, with the price of ramyeon in October jumping almost 12 percent on-year, the biggest gain in more than 12 years.

Min Suk-hyen, Arirang News.

http://www.arirang.co.kr/News/News_V...sp?nseq=297928

Dapaknya bakal kemana-mana termasuk di Kosel

KRAVZHENKO dan 4 lainnya memberi reputasi

5

1.4K

43

Komentar yang asik ya

Urutan

Terbaru

Terlama

Komentar yang asik ya

Komunitas Pilihan