Quote:

Indonesia’s rupiah surged the most since May 2012 and stocks closed at the highest level since August amid signs investors are returning to the nation’s assets.

The rupiah jumped 1.7 percent to close at 14,250 a dollar after rising as much as 2.2 percent earlier, prices from local banks show. The currency has strengthened 2.7 percent this week, paring its loss this year to 13 percent. The Jakarta Composite Index of shares advanced 2.4 percent, following a 3.2 percent gain on Monday.

The rupiah led a rally in Asian currencies on Tuesday amid speculation the Federal Reserve will delay raising interest rates until next year. There’s a “multi-decade opportunity” in emerging markets including Indonesia following the recent selloff, Michael Hasenstab, who oversees 30 funds with $143 billion in assets at Franklin Templeton in San Mateo, California, said in an interview. President Joko Widodo last week asked state energy firm PT Pertamina to recalculate domestic fuel prices as part of a third batch of policy stimulus set to be announced on Thursday.

“The rupiah is a big beneficiary of fund managers commenting on buying emerging-market assets on cheaper valuations,” said Saktiandi Supaat, the head of foreign-exchange research at Malayan Banking Bhd. in Singapore.

“All the measures the government and the central bank put in place show their perseverance in supporting the rupiah.”

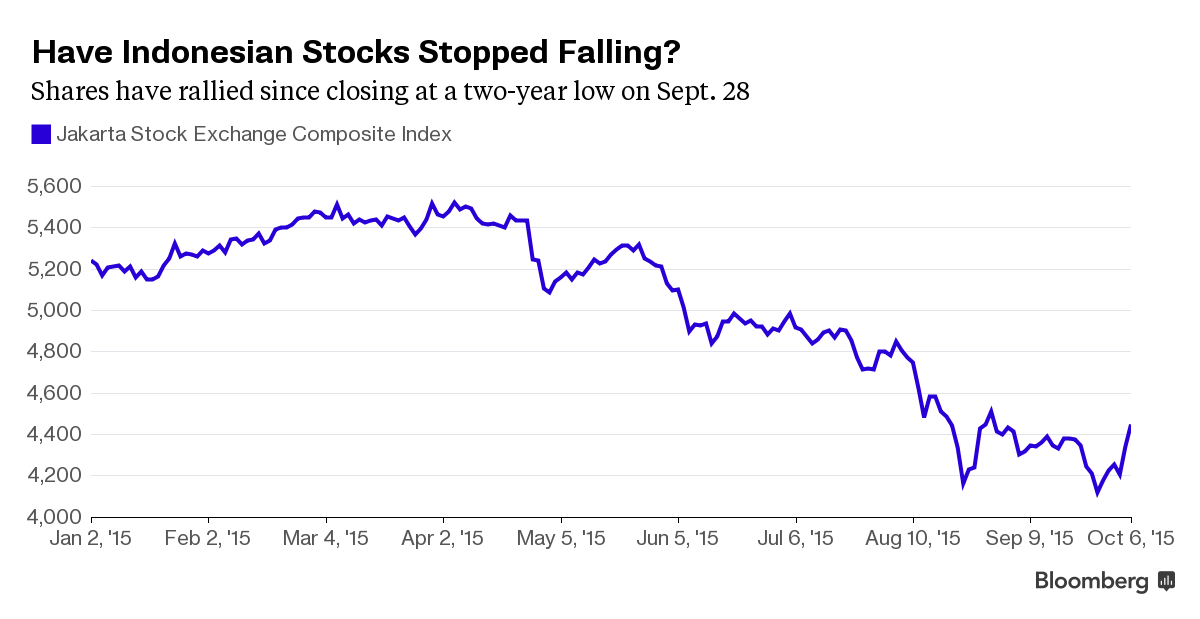

Foreign funds pulled $1.2 billion from Indonesian stocks and 11.86 trillion rupiah ($833 million) from the country’s local-currency bonds last quarter amid an emerging-market selloff driven by a slowdown in China’s economy and the U.S. moving closer to raising interest rates. The Jakarta share gauge has rallied 7.9 percent since closing at a two-year year low on Sept. 28.

The yield on 10-year sovereign bonds fell one basis point to 9.13 percent and has dropped 68 basis points in the five days through Tuesday, according to prices from the Inter Dealer Market Association. It reached a five-year high of 9.81 percent on Sept. 29.

Sentiment Turning

“There’s a mix of local and foreign investors returning to the market as sentiment turns for the better,” said Ikhwani Fauzana, head of rates trading at PT Bank Negara Indonesia in Jakarta.

Bank Indonesia began intervening in the onshore forwards market this month, and is also seeking to curb the short-term supply of rupiah in the local market in order to stem borrowing to buy dollars.

The authority sees the currency’s fundamental value at 13,300 to 13,700, Deputy Governor Perry Warjiyo said Sept. 30.

Maybank’s Supaat forecasts the currency will decline to 15,000 a dollar by year-end, but he said central bank policies to stabilize the rupiah and the government’s resolve in attracting investment may bring it closer to 14,500.

U.S. employers added fewer positions in September than the lowest estimate in a Bloomberg survey, according to a report released Friday, a sign the Fed may not increase borrowing costs this year.

“There isn’t anything fundamental going on,” said Sean Yokota, the Singapore-based head of Asian strategy at Skandinaviska Enskilda Banken AB. “After the payroll numbers people were caught long dollars and there’s a positioning wind-down,” he said, adding that he thought the rally in the rupiah was temporary.

PT Astra International, which distributes automobiles and operates mines, jumped 11.3 percent, providing the biggest boost for the benchmark stocks index. PT Bank Mandiri rose 8.5 percent and PT Bank Central Asia advanced 3.2 percent.

“Investors are seeing signs that the rupiah has stabilized and won’t decline significantly further,” said Kim Kwie Sjamsudin, head of research at PT Yuanta Securities Indonesia in Jakarta. “Once it is seen stabilizing, people will find valuations of Indonesian stocks attractive.”

- Rupiah menguat

- Minggu lalu memimpin di Asia

- Investor kembali semenjak market sentiment membaik

- Fundamental value di set untuk 13.000

- Prediksi awal dari Maybank adalah 15.000 pada akhir tahun, namun katanya ebrkat pemerintah berhasil distabilkan mendekati 14.500 dengan menarik investor

Update :

Nilai tukar Rupiah pagi ini 13.300 per 1 dollar. Cukup cepat mengingat dua minggu lalu masih 14.500-an

Komentar TS :

Bener juga waktu Jokowi bilang September-Oktober perekonomian bakal membaik.

Thank you, Jokowi.